DIGITAL NOTES

Reinventing the future of healthcare

Only available to qualified investors

OWN HSHG DIGITAL NOTES IN YOUR PORTFOLIOS

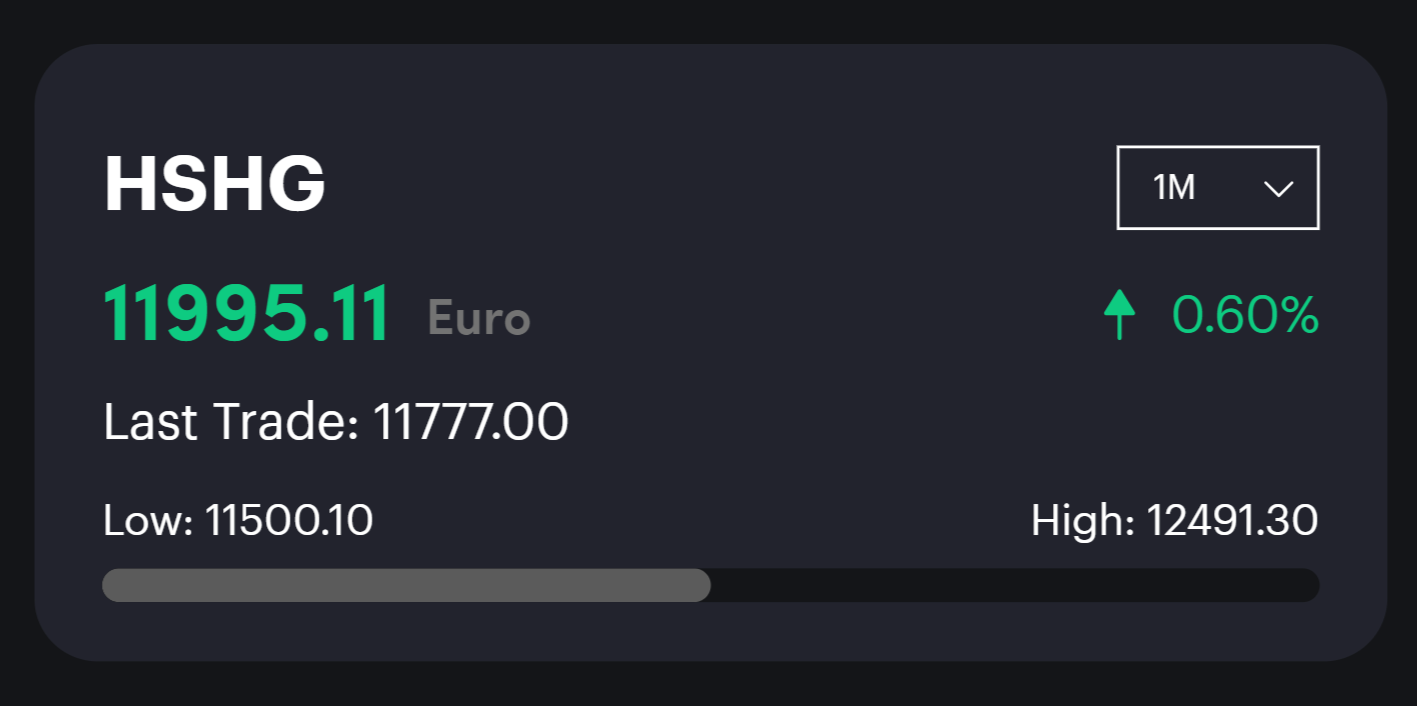

Harley Street Healthcare group is issuing digital trade-able redeemable notes under the ticker symbol <HSHG> on Assetera Financial Markets - a fully regulated financial market in the EU. HSHG has completed its onboarding process including KYC/DD to issue a digital note as part of the fintech innovation drive in the EU.

As a digital note's holder, investors gain access to exclusive add-on benefits into premium memberships, digital healthcare product, and besides financial opportunities.

BX Digital and Assetera Capital Markets

Retail, professional and institutional clients can invest in and trade any digital securities which are compliant with ESMA regulation such as stocks, bonds, funds, open-ended AIFs, derivatives, CFDs, loan, revenue participation or other.

HOW DOES IT WORK?

The denomination of the digitally tradeable/ marketable redeemable note is a GBP/CHF 1,000 ideally bought in a bundle of CHF 11,200 ( each equivalent in Euro/GBP ). So each bundle is made up of CHF 1,000 secured digital redeemable notes.

Two options:

1) Investors are able to buy CHF 1000 and for which they receive CHF 1120, extra 12% bonus are added by HSHG, giving the buyers an instant 12% return on the principal, which becomes redeemable after 9-months.

2) Investors are also allowed to buy the CHF 1000 notes at 12% discount. So instead of paying CHF 1000, they can opt to pay CHF 880 and have CHF 1000 of digital notes allocated.

The redemption upon request will be in cash or equity. Lifetime of the notes is 4 years, and it is also linked to the IPO. These notes are secured and available to investors at a discount. All the KYC/DD and counterparty risk is mitigated by the regulated exchange giving the investors the comfort they would need. BX Digital ( part of BX Swiss ) and Assetera will also quote bid/ask to facilitate secondary liquidity in the asset class (the digital notes). This will be supported by firms like Balfour Capital Group and others. Harley Street is also working with a selected group of market makers to create deeper liquidity in the product.

BENEFITS OF OWNERSHIP

Innovation

Authorisation

Monetise

ESG

Shariah Compliant

Balfour Capital Group & Affiliates

They are dedicated to fulfilling the personal preferences and ambitious financial goals of top-tier institutions and astute High Net Worth Individuals in a singular way.

“Where you matter the most”

HSHG location

United Kingdom

.jpg?height=2000&name=Untitled%20design%20(3).jpg)

Canada

The Balkans

.jpg?height=2000&name=Untitled%20design%20(1).jpg)

India

.jpg?height=2000&name=Untitled%20design%20(2).jpg)

Italy

.jpg?height=2000&name=Untitled%20design%20(4).jpg)

More locations

What will move the pricing and how will the redemption work ?

the supply and other factors including IPO that will serve as a tail wind.

To support the product and investors confidence, HSHG will be committed to continuously informing the market through a series of announcements that may improve liquidity and valuation of the notes inline with investors sentiment.

RCK Analytics

They work with finance and investment firms, private equity firms, asset managers and hedge funds, investment banks and brokerage firms, market research organisations, consulting firms, and corporations from diverse industries.

Harley Street Healthcare Group

HARLEY of LONDON (HQ) is a state-of-the-art centre designed as a home and sanctuary for free thinking, innovative and transformative ideas and personal as well as business development specifically for entrepreneurs and executives, meeting their 360 degrees business, and wellness needs.

The wellness of entrepreneurs and executives matters, and it has a direct correlation with corporate profitability. In the wake of the pandemic the statement that " health is wealth " couldn’t be more true. It has never been more critical for individuals and businesses to address people’s health and mental well-being head-on.

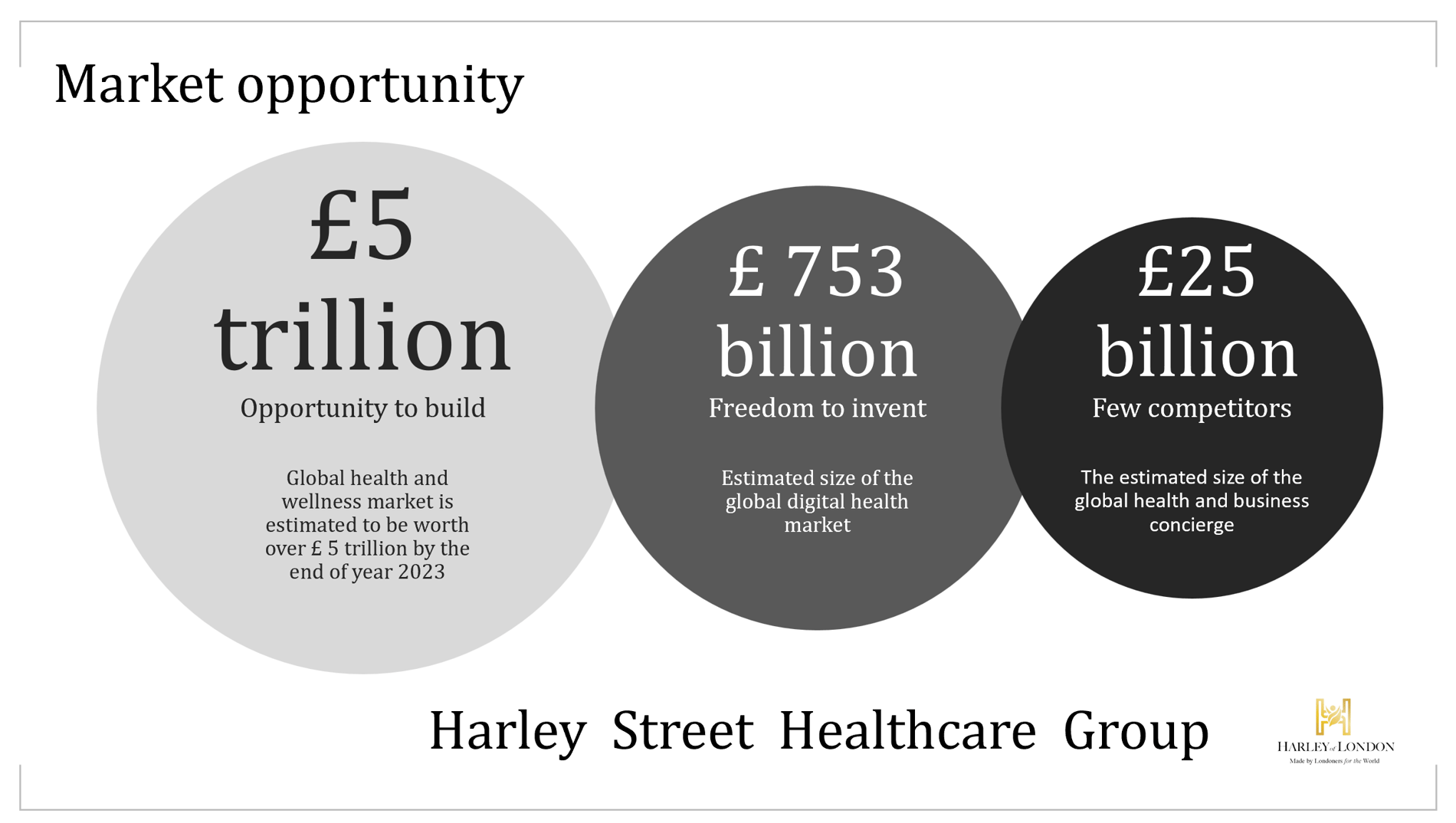

Healthcare industry growth

Across the globe, people are living longer. While developed markets are dealing with ageing population. Populations in emerging markets are exploding. Drug development costs are skyrocketing. These are just a few drivers of exponential growth in healthcare. In fact, the global healthcare budget will be an estimated and astounding $15 trillion by 2030. Digital health brings together a vast amount of industries that include genomics, ingestibles and implantables, wearables, sensors, retailers, social media, AI, analytics, clinical data and electronic health records just to name a few.